How Redaction Software Helps Insurance Firms Stay Compliant

by VIDIZMO Team, Last updated: June 2, 2025, Code:

Insurance companies increasingly rely on video and audio recordings for claims, training, and customer service. This blog explores the critical role of redaction software in protecting sensitive data and highlights how VIDIZMO Redactor helps insurers meet compliance and privacy needs.

In today's rapidly advancing digital landscape, where technology is driving the entire world, the profound impact of digital data extends to nearly every industry. The insurance sector is no exception, embracing the power of videos and audio recordings to revolutionize their operations.

From claims investigations to customer service, these multimedia formats have empowered insurance companies to streamline processes and deliver exceptional experiences.

While the benefits of utilizing videos and audio for multiple purposes in the insurance sector are undeniable, it also brings forth a crucial concern: Data Privacy.

This blog highlights the role of videos in the insurance sector, the need for redaction in various case scenarios, and how VIDIZMO Redactor emerges as the solution to safeguard data privacy concerns faced by insurance companies.

Exploring the Impact of Audio and Video Recordings in the Insurance Sector

The impact of audio and video recordings in the insurance sector is significant. They provide digital evidence, facilitating accurate claims assessment, improving fraud detection, and expediting the claims process.

The rate of false claims has increased. Insurance Fraud Report 2022 reported that:

“About 20% of insurance claims files in 2022 were suspected to be fraudulent.”

Digital recordings enhance communication with customers, boost customer satisfaction, and streamline customer service operations. Additionally, video-based training improves employee performance, increases efficiency, and reduces errors. Overall, audio recordings and videos contribute to informed decision-making, improved efficiency, and better customer experiences in the insurance industry.

Here are some common examples of different case scenarios where videos and audio can be utilized to enhance insurance companies' operational performance:

Claims Investigations

Video and audio recordings can be used to assess the validity of insurance claims. These recordings provide digital evidence that helps assess the validity of claims, determine liability, and expedite the claims settlement process. Additionally, audio recordings of witness statements or interviews provide valuable insights and assist in verifying facts.

Risk Assessment and Underwriting

Videos and images are employed to evaluate risks associated with insuring properties or vehicles. Aerial footage or imagery can reveal potential hazards and property conditions or evaluate the overall risk profile. For instance, Insurance industries use drones for risk assessment, damage monitoring, and claim investigations for a wide range of properties. Drone footage aids insurance companies in making informed underwriting decisions and setting appropriate premiums for policyholders.

Fraud Detection and Prevention

Videos play a crucial role in detecting insurance fraud. Surveillance cameras capture footage that can reveal accidents, false claims, or exaggerated injuries. By analyzing videos, insurers can identify suspicious patterns and fraudulent activities and take necessary action to mitigate fraud risks.

Customer Service and Communication

Insurance companies utilize videos and audio recordings for customer interactions. Video conferencing and recorded calls facilitate efficient communication, claim discussions, and policy explanations and provide personalized service. These recordings aid in resolving disputes and ensure accurate documentation of customer interactions.

Training and Education

Videos are instrumental in training insurance professionals. They are used to educate employees on claims handling procedures, compliance regulations, risk management, and customer service skills. Video-based training materials improve knowledge retention, enhance skills, and ensure consistent training across the organization.

Beneath the surface of the numerous benefits of digital data discussed above, there is a hidden challenge that insurance companies must address swiftly to avoid potentially serious consequences. What is it?

Preserving Data Privacy is the answer!

According to a KPMG Survey:

“86% of the U.S general population says that data privacy is a growing concern.”

Failure to address this challenge adequately can result in hefty fines, penalties, and damage to their reputation among customers.

Data Privacy: The Key Challenge Encountered by Insurance Companies when Handling Digital Data

In an era where privacy breaches dominate headlines, insurance companies must comply with legal regulations and protect sensitive information within audio and videos. By prioritizing data privacy, insurers can uphold customer trust, mitigate legal risks, and safeguard their reputation in a constantly evolving digital world.

To protect the privacy of data, redaction jumps in to rescue insurance industries from data breaches. In the insurance sector, redaction plays a crucial role in preserving privacy and compliance in various case scenarios, which are as follows:

-

During claims investigations, video and audio evidence, such as surveillance footage and recorded statements, are collected. Redaction allows insurance companies to blur Personally Identifiable Information (PII) of irrelevant individuals, safeguarding their privacy while maintaining the integrity of the investigation reports.

-

Redaction is also vital in fraud prevention, ensuring sensitive information of innocent parties is protected while still providing evidence for investigations.

-

When it comes to customer interactions or recorded calls, redaction helps maintain policyholder privacy by obscuring PII and adhering to privacy regulations like GDPR or CCPA.

-

In training and education, redaction is required to hide any confidential or sensitive data within training videos.

-

Additionally, during dispute resolution, redaction ensures privacy compliance by concealing the identities of non-involved individuals in the video and audio evidence, maintaining the credibility of the insurance data.

The implementation of redaction in these diverse case scenarios enables insurance companies to navigate privacy challenges while upholding legal requirements and protecting sensitive information.

Various redaction solutions are available to cater to the redaction needs of insurance videos and audio recordings. One such solution is the VIDIZMO Redactor Tool.

VIDIZMO Redactor Tool: The Leading Solution for Insurance Industries

To tackle the challenge of data privacy in the insurance sector, VIDIZMO Redactor Tool serves as the ultimate solution. With its robust and advanced redaction capabilities, this leading software empowers insurance companies to redact PII, PHI, and other confidential data from videos, images, and audio recordings. By harnessing the power of VIDIZMO Redactor, insurers can fulfill privacy compliances, safeguard sensitive information, and maintain the trust of their customers.

VIDIZMO’s AI-powered solution provides comprehensive features for the automatic detection, tracking, and redaction of various objects in videos, audio, and images using artificial intelligence.

VIDIZMO Redactor provides the following features:

-

Detect and track personal information such as faces and people frame by frame within videos automatically, ensuring accuracy and efficiency in the detection process.

-

To save time and minimize human errors, VIDIZMO Redactor offers AI-Powered Video Redaction. It provides various redaction styles, including blurring, pixelating, or adding a solid redaction box over sensitive information within video files.

-

Bleep or mute specific spoken words in audio clips that contain personally identifiable information (PII) to safeguard the privacy of individuals.

-

VIDIZMO provides editing capabilities that simplify the removal of unnecessary parts from videos.

-

Transcription capabilities enable automatic speech-to-text conversion in multiple languages. Additionally, the VIDIZMO solution supports translation into more than 50 languages. It provides the flexibility to hide specific texts from generated transcriptions, ensuring confidentiality as needed.

-

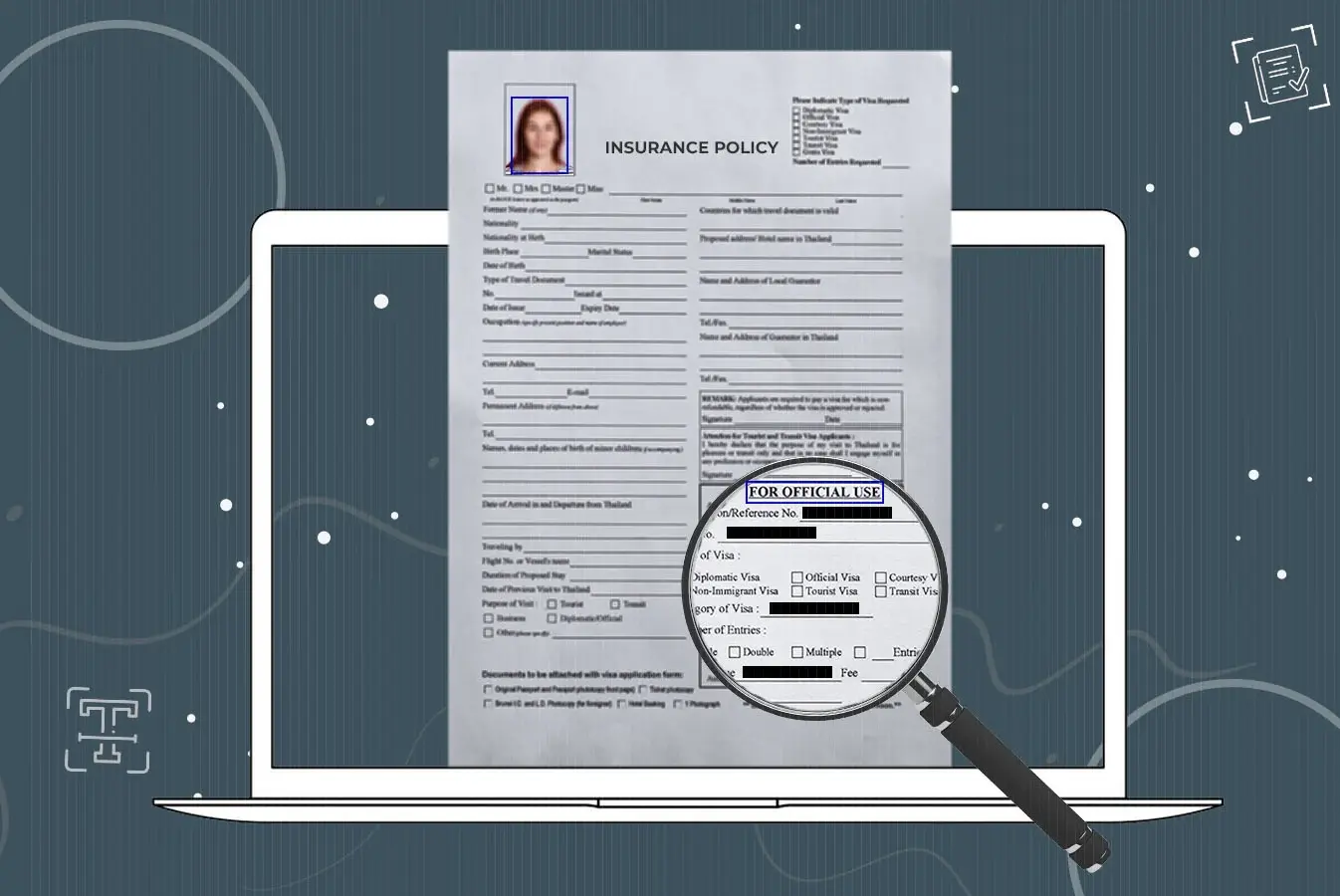

VIDIZMO also offers the functionality of document redaction that enables insurance industries to redact multiple types of insurance documents with ease.

Protect Privacy with Redaction Software for Insurance Firms

As the use of video and audio continues to grow in the insurance sector, so does the need to protect sensitive data. Redaction software for insurance firms plays a vital role in safeguarding personally identifiable information (PII) and ensuring compliance with data privacy regulations like GDPR, CCPA, and HIPAA.

Whether it's during claims investigations, fraud detection, customer service recordings, or employee training, redaction software helps insurance companies securely manage their multimedia content. VIDIZMO Redactor stands out as a powerful redaction solution, offering AI-powered capabilities to redact faces, voices, text, and sensitive content across videos, audio, and documents.

Ready to protect your digital data and ensure compliance? Start your Free Trial of VIDIZMO Redactor or Contact Us to explore how VIDIZMO’s redaction software for insurance firms can help you secure privacy without compromising productivity.

People Also Ask

Why do insurance companies need redaction software?

Insurance companies need redaction software to protect sensitive data in videos, audio recordings, and documents. Redaction ensures compliance with data privacy regulations and helps safeguard personally identifiable information during claims investigations, customer interactions, and training.

How does redaction software help with insurance claims investigations?

Redaction software helps insurance firms by masking faces, voices, and other PII in video or audio evidence collected during claims investigations. This maintains the integrity of the investigation while protecting the privacy of uninvolved individuals.

What are the key features of redaction software for insurance companies?

Key features of redaction software for insurance include automatic face detection and tracking, AI-powered redaction styles, audio muting or bleeping for sensitive speech, transcription editing, and support for document redaction. These tools ensure comprehensive data privacy.

How does VIDIZMO Redactor ensure data privacy in insurance firms?

VIDIZMO Redactor uses AI to automatically detect and redact sensitive information from video, audio, images, and documents. This helps insurance firms comply with privacy regulations like GDPR and CCPA while maintaining operational transparency and customer trust.

What types of insurance data can be redacted using software?

Redaction software can be used to conceal personal identifiers in claim footage, recorded interviews, customer service calls, training videos, and insurance documents. This includes faces, license plates, names, voices, and sensitive textual data.

Why is redaction important for customer service recordings in insurance?

Redaction is vital for customer service recordings because it removes personal data while preserving the conversation context. This ensures compliance with data protection laws and reduces the risk of privacy breaches during audits or reviews.

How does redaction software reduce legal risk for insurance providers?

Redaction software minimizes legal risk by ensuring sensitive data is not exposed or mishandled. It helps insurance firms comply with privacy regulations, protecting them from lawsuits, fines, and reputational damage.

Can redaction software be used for insurance training videos?

Yes, redaction software is used in training videos to obscure any confidential information or real case data. This allows organizations to educate employees without compromising privacy or breaching data policies.

What makes VIDIZMO Redactor ideal for insurance applications?

VIDIZMO Redactor is ideal for insurance firms due to its AI-powered capabilities that automate redaction in multimedia files. It supports multiple file types, offers advanced customization, and ensures compliance with industry-specific privacy standards.

How does redaction support privacy compliance in the insurance industry?

Redaction supports privacy compliance by ensuring that sensitive data is hidden before content is shared or stored. This aligns insurance firms with regulations like HIPAA, GDPR, and CCPA, helping them avoid penalties and maintain ethical standards.

Jump to

You May Also Like

These Related Stories

Redacting Insurance Documents with Redaction Software

The Need for Audio Redaction in the Insurance Sector

No Comments Yet

Let us know what you think