Redacting Insurance Documents with Redaction Software

by Moazzam Iqbal, Last updated: June 30, 2025, ref:

Insurance companies handle many documents daily, from policy applications and claim reports to underwriting files and settlement agreements. Manually managing these documents is not only labor-intensive but also prone to errors, consuming valuable time and resources.

According to Verizon's 2024 Data Breach Investigations Report, approximately 68% of data breaches involve a non-malicious human element, such as errors or social engineering attacks. For insurance companies, failing to properly redact personally identifiable information (PII) in documents can lead to compliance violations, legal consequences, and loss of customer trust.

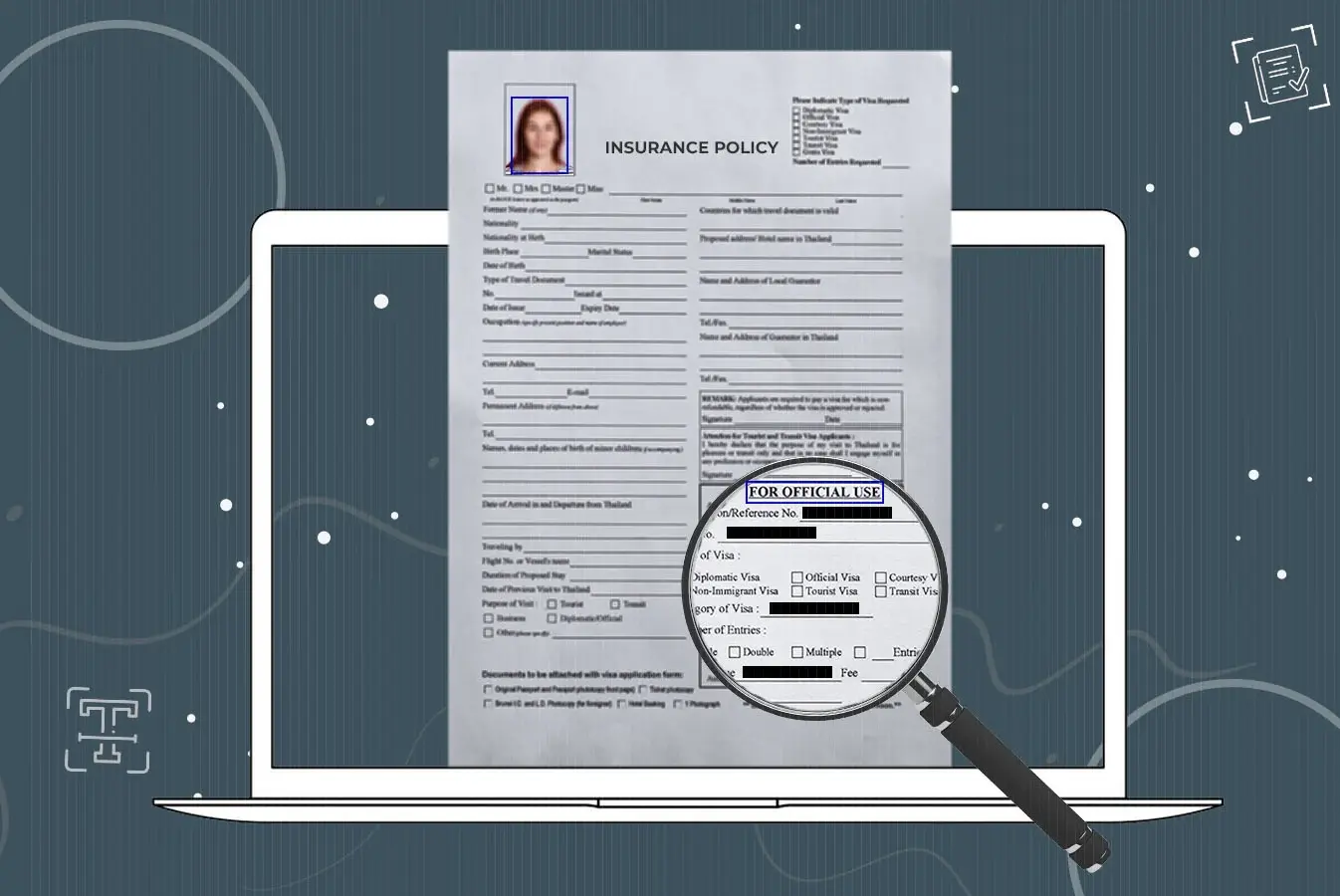

To mitigate these risks, insurance providers must leverage AI-powered document redaction tools that ensure accuracy, efficiency, and compliance. With advanced redaction software, they can automate the process of removing sensitive data from various documents, safeguarding policyholder information while streamlining workflows.

In this blog, we’ll explore the necessity of redaction in different types of insurance documents, the challenges companies face in manually redacting data, and how implementing advanced redaction tools can help insurance organizations maintain regulatory compliance while optimizing document management.

From Policies to Claims: Uncovering the Necessity of Document Redaction Tool

To ensure comprehensive privacy protection, insurance companies must identify the types of documents that require redaction. This includes insurance policies, endorsements, claims-related documents, customer and applicant information forms, as well as correspondence and communication records, and other document types.

Claim Reports

When policyholders file a claim, they are required to submit a claim form that contains vital information such as their medical history, employment details, and financial information. This information becomes crucial evidence in insurance litigation cases, as it represents the insurance carrier's handling and processing of the claim. However, the claim file also contains highly sensitive and personal data, including medical records and social security numbers, particularly in the life, health, or disability insurance cases.

Balancing the need to utilize the information in litigation with privacy concerns poses a challenge. One approach is to thoroughly review the claim file and redact any personal information, commonly referred to as "personal identifiers," to protect privacy when entering the information into the public court record, as stated in the Federal Rule of Civil Procedure 5.2. Privacy Protection for Filings Made with the Court.

Another approach is to submit the claim file under seal. However, a compelling reason must be presented to the court for doing so.

Insurance Policy Documents

Insurance policy documents are legal contracts between an insurance company and a policyholder that outline the terms and conditions of an insurance policy. These documents provide detailed information about the coverage, premiums, deductibles, limits, and exclusions associated with the insurance policy. They serve as a binding agreement between the insurer and the insured, establishing the rights, obligations, and responsibilities of both parties.

Insurance policy documents typically do not require redaction as they primarily contain general terms and conditions, coverage details, and legal provisions. These documents generally are not personalized to individual policyholders and do not contain sensitive personal information.

However, there may be some exceptions. In some instances, policy endorsements or addendums may include specific personal information, such as changes in address or contact details. In such cases, it may be necessary to redact or protect personal information when sharing these specific documents.

In addition to that, the personal information of policyholders, such as their names, addresses, contact details, and Social Security numbers, should be redacted to safeguard their privacy.

Underwriting Documents

Underwriting insurance documents are vital records used in the evaluation and assessment of risks involved in providing insurance coverage to individuals or entities. These documents hold the key to determining policy terms, conditions, and premiums. They consist of application forms completed by policy applicants, containing essential information such as personal details, medical history, lifestyle habits, and financial information. These application forms serve as the primary source of underwriting information.

In the case of health or life insurance, underwriters require access to the applicant's medical records. These records encompass diagnoses, treatment histories, medications, and reports from healthcare providers. Access to medical records allows underwriters to evaluate an individual's health condition and assess potential risks accurately.

Considering the sensitive nature of underwriting documents, it is crucial to redact underwriting documents before any disclosure to protect the privacy of the individuals involved in the underwriting process. Proper redaction ensures compliance with privacy regulations and safeguards sensitive information from unauthorized access.

Settlement Agreements

Insurance settlement agreements are legal contracts that define the terms and conditions under which an insurance claim will be resolved. When an individual experiences a loss or damage covered by an insurance policy, they file a claim with their insurance company.

These agreements outline various aspects of the settlement, including the amount of compensation to be provided, the scope of coverage, any exclusions or limitations, and the terms for releasing the insurance company from further liability related to the claim.

Settlement agreements in insurance claims may include financial settlements, terms, and conditions. Redaction can be applied to hide specific financial details, banking information, or any confidential terms that parties involved wish to keep private.

Insurance Applications

Insurance applications are the initial documentation completed by individuals or businesses seeking insurance coverage. During the application process, applicants disclose personal, medical or business details, submit relevant documentation, and answer specific questions related to the type of insurance they are seeking.

These applications play a crucial role in helping insurers assess the applicant's risk profile and determine factors such as premium rates, coverage limits, and policy terms. However, it is important to be careful when completing insurance applications to safeguard privacy.

Personally identifiable information (PII), including sensitive personal data or confidential business strategies, should be redacted to protect privacy and prevent potential misuse.

Reinsurance Agreements

A reinsurance agreement is a contract between an insurance company (the ceding insurer) and another insurance company (the reinsurer), where the ceding insurer transfers a portion of its insurance liabilities and risks to the reinsurer in exchange for payment of a premium.

Reinsurance helps insurance companies manage their risk exposure by spreading it across multiple insurers, allowing them to handle large or catastrophic losses more effectively.

Reinsurance contracts involve multiple parties and may contain sensitive financial and proprietary information. Redacting clauses related to pricing, profit sharing, or specific contractual terms is crucial to maintaining confidentiality.

Regulatory Compliance Reports

Insurance compliance refers to the adherence of insurance companies to laws, regulations, and guidelines set by regulatory bodies. It encompasses various aspects, including licensing, product and pricing regulations, policyholder disclosures, privacy and data protection, anti-fraud measures, claims handling, and financial solvency.

Compliance ensures fair and ethical practices, protects policyholders' rights, and maintains market stability. Regulatory bodies oversee compliance, and non-compliance can result in penalties, fines, license revocation, and legal consequences.

In this case scenario, insurance companies may need to redact confidential information in compliance reports to safeguard trade secrets, proprietary algorithms, and other sensitive data.

Internal Correspondence

Successful insurance companies utilize various communication tactics to engage with their clients, including emails, memos, interdepartmental communication, internal newsletter, instant messaging, internal reports, and social media interactions.

Emails, memos, or other internal communication within insurance companies may contain sensitive information that requires redaction. This includes discussions about policyholders, claimants, or business strategies that should be kept confidential.

Fraud Investigation Reports

Insurance fraud investigations are conducted to uncover false insurance claims, which are illegal and lead to higher insurance premiums. Insurers employ a range of techniques to evaluate potential fraud, including surveillance, obtaining medical reports, analyzing claimant history, conducting coverage analysis, speaking to witnesses, performing background checks, and scrutinizing physician billing records.

These investigations safeguard insurers from inappropriate claims and require the expertise of experienced legal teams.

It is crucial to redact sensitive information during ongoing fraud investigations to protect the personal data and privacy of potential victims, informants, or other involved individuals.

Data Breach Response Plans

Data breach response plans are essential for insurance companies to effectively address and mitigate the consequences of cybersecurity incidents.

In the event of a data breach, insurance companies often prepare response plans that contain detailed steps and protocols. Redaction can be applied to hide specific technical details or sensitive information that malicious actors could exploit.

Challenges Faced by Insurance Companies in Redacting Documents

As discussed above, any information identifying an individual within different types of insurance documents must be concealed before third-party disclosure. But the process of document redaction is not that simple!

Insurance companies encounter several challenges while redacting documents. Let us explore some of these challenges:

Detecting PII in Documents

Insurance documents contain PII, including names, addresses, social security numbers, medical records, and financial details. The challenge lies in accurately identifying and redacting all types of sensitive and personal information within the bulk of documents. Digging through various documents and identifying information manually is a daunting task, prone to errors, and difficult to scale.

Handling Various Document Formats and Sources

Insurance companies deal with a wide range of document formats and sources, including paper documents, scanned files, emails, and digital records. Each format presents unique challenges in terms of extracting and redacting information.

Balancing Data Privacy and Accessibility

While redacting sensitive information is crucial, insurance companies must strike a balance between data privacy and maintaining document accessibility. Some information may need to be shared with authorized personnel or third parties for legal, audit, or collaborative purposes. Redacting documents without compromising their integrity and usefulness can be challenging.

Ensuring Consistency and Accuracy

Consistency and accuracy are paramount in the redaction process to avoid any accidental disclosure of sensitive information. Inconsistencies or errors in redaction can result in unintended data exposure or compromised compliance.

Fulfilling Compliance Requirements

Insurance companies must comply with ever-changing data privacy regulations, such as the General Data Protection Regulation (GDPR, the Health Insurance Portability and Accountability Act (HIPAA), the Freedom of Information Act (FOIA), and the California Consumer Privacy Act (CCPA).

Staying up to date with these regulations and implementing the necessary redaction measures can be complex and time-consuming. Failure to comply can result in severe penalties and reputational damage.

Marvin E. Lewis, Assistant Chief of the FBI’s FOIA, has the following remarks regarding document redaction:

“At the FBI, while we release nearly a million document pages per year, we use fairly standard methods for redacting records that have been requested under the FOIA.”

It is imperative to know what measures are required to be taken by insurance companies to overcome challenges related to document redaction.

The answer lies in the document redaction tool!

Insurance companies require an advanced document redaction tool to redact documents quickly and effortlessly.

One such tool is VIDIZMO Redactor!

Stay Ahead in Game: Empowering Insurance Companies with VIDIZMO Redactor Tool

VIDIZMO Redactor is a cutting-edge, user-friendly solution that empowers organizations to seamlessly redact personally identifiable information (PII) within videos, audio, images, and documents. With its robust AI capabilities and compliance-driven features, VIDIZMO Redactor ensures data privacy while meeting regulatory compliance requirements.

Intelligent Keyword Search:

VIDIZMO Redactor simplifies the redaction process by allowing you to search for specific words and phrases within documents that contain personal or confidential information. With just a few clicks, you can identify and redact these keywords, saving valuable time and effort. You can use regular expression patterns to search for and redact various types of numbers, such as phone numbers, social security numbers, and credit card numbers, ensuring comprehensive data protection.

Manual Text Selection and OCR:

VIDIZMO Redactor provides the flexibility to manually select text areas within documents and draw bounding boxes for precise redaction. This ensures that only the necessary information is concealed, maintaining document integrity. Additionally, the Optical Character Recognition (OCR) functionality allows you to redact scanned documents efficiently, extending the redaction capabilities beyond standard text-based files.

Bulk Document Redaction:

Efficiency is key when dealing with a large volume of documents. VIDIZMO Redactor enables you to select multiple documents and perform redaction simultaneously, saving time and effort. This feature streamlines the redaction process, making it convenient and efficient for organizations dealing with numerous files on a regular basis.

Apart from document redaction, VIDIZMO Redactor offers audio and video redaction features as well. Learn more about audio and video redaction use cases in the insurance sector in this blog, The Importance of Redaction in the Insurance Sector.

Secure Your Documents with an AI-Powered Document Redaction Tool

In an industry where sensitive data is constantly being processed, insurance companies cannot afford to overlook data privacy and compliance. From claims reports to underwriting documents, ensuring proper redaction is crucial to protecting personally identifiable information (PII) and avoiding regulatory penalties. Manual redaction is time-consuming and prone to errors, making an AI-powered document redaction tool essential for efficiency and accuracy.

By implementing redaction software, insurance providers can automate the removal of sensitive data, streamline workflows, and maintain compliance with privacy regulations.

Learn more about VIDIZMO Redactor, or contact us today to discuss your needs and explore how we can help.

Ready to enhance document security and protect your policyholders' data? Start your free trial today!

People Also Ask

What is a document redaction tool, and why is it important for insurance companies?

A document redaction tool is a software solution that helps organizations automatically remove or obscure sensitive information from documents. For insurance companies, redacting personally identifiable information (PII) is essential to comply with data privacy regulations like HIPAA, GDPR, and CCPA while protecting policyholder information from unauthorized access.

How does redaction software improve efficiency in insurance document management?

Redaction software automates the process of identifying and concealing sensitive data, reducing the need for manual redaction. This not only saves time but also minimizes human errors, ensuring accuracy and compliance with legal requirements. It enables insurance companies to process large volumes of documents quickly while maintaining data security.

What types of insurance documents require redaction?

Several insurance documents require redaction, including claims reports, underwriting documents, settlement agreements, reinsurance contracts, and regulatory compliance reports. These documents often contain PII, financial information, or proprietary business data that must be protected before sharing with third parties.

How does AI-powered redaction software detect sensitive information in documents?

AI-powered redaction software uses machine learning algorithms and Optical Character Recognition (OCR) technology to scan and identify PII, such as names, addresses, Social Security numbers, and medical records. It can automatically redact sensitive data while ensuring compliance with industry regulations.

Is manual redaction still a reliable method for securing insurance documents?

Manual redaction is prone to human error, time-consuming, and difficult to scale, making it an unreliable method for securing sensitive information in insurance documents. Automated document redaction tools offer higher accuracy, speed, and efficiency, significantly reducing the risk of data breaches or regulatory violations.

What are the common compliance regulations that require insurance companies to redact documents?

Insurance companies must comply with several data privacy laws, including the General Data Protection Regulation (GDPR), the Health Insurance Portability and Accountability Act (HIPAA), the California Consumer Privacy Act (CCPA), and the Freedom of Information Act (FOIA). These regulations mandate the protection of personal and financial data, making redaction a crucial step in compliance.

Can redaction software handle different document formats used in insurance?

Yes, advanced redaction software can process multiple document formats, including PDFs, Word documents, scanned images, and even handwritten forms. OCR technology allows the software to extract and redact text from various file types, making it highly versatile for insurance document management.

How does redaction software ensure consistency in large-scale document processing?

Automated document redaction tools use predefined rules, AI models, and keyword detection to ensure consistency in redacting sensitive information across multiple documents. Unlike manual redaction, automation eliminates inconsistencies and enhances the reliability of data protection efforts.

Does redaction software also work for audio and video files used in insurance investigations?

Yes, some redaction software solutions offer multi-format capabilities, including audio and video redaction. This is especially useful for insurance fraud investigations, recorded claims interviews, and legal proceedings where sensitive information needs to be protected.

How can insurance companies get started with an AI-powered document redaction tool?

Insurance companies can start by exploring different document redaction tools that offer AI-driven automation, OCR capabilities, and compliance support. Many providers offer free trials, allowing companies to test the software and integrate it into their document management workflows for enhanced security and efficiency.

Jump to

You May Also Like

These Related Stories

Redaction Software for Complying with Missouri Redaction Rules

How to Redact Legal Documents: A Complete Guide to Protecting PII

No Comments Yet

Let us know what you think