Video Platform for Banking: A Complete Guide

by Hassaan Mazhar, Last updated: January 30, 2026, ref:

The banking and financial services industry is undergoing a significant digital transformation, and video has emerged as a critical tool for everything from employee training to executive communications. According to Allied Market Research, the global video banking service market is projected to reach $247.9 billion by 2031, growing at a CAGR of 13.6%.

But here's what many organizations discover: consumer-grade video tools like YouTube or basic video conferencing platforms simply aren't built for the unique demands of financial institutions. Banks need enterprise video platforms that combine the ease-of-use of modern video technology with the security, compliance, and governance capabilities that regulators demand.

This guide explores how financial institutions can leverage enterprise video platforms to transform their operations while maintaining strict regulatory compliance.

What Is a Video Platform for Banking?

A video platform for banking is a specialized enterprise video content management system designed to meet the unique requirements of financial institutions. Unlike general-purpose video hosting services, banking video platforms provide:

- Enterprise-grade security: End-to-end encryption (AES-256), DRM protection, and secure video delivery

- Regulatory compliance: Built-in support for SOC 2 Type II, FINRA, GLBA, PCI-DSS, and GDPR requirements

- Audit capabilities: Comprehensive logging, access tracking, and compliance reporting

- Flexible deployment: On-premises, private cloud, hybrid, or SaaS options to meet data sovereignty requirements

- Integration capabilities: Connection with existing LMS, SSO, and enterprise systems

See more: Enterprise Video Platform

Key Use Cases for Video Platforms in Banking

Financial institutions deploy enterprise video platforms across multiple business functions. Here are the most impactful applications:

1. Regulatory Compliance Training

Banks face an ever-growing list of compliance requirements: Anti-Money Laundering (AML), Know Your Customer (KYC), the Bank Secrecy Act (BSA), and numerous FINRA regulations. Video-based training offers several advantages over traditional classroom instruction:

- Consistent delivery: Every employee receives identical training content, eliminating variations in instruction quality

- Trackable completion: Detailed analytics show who watched what content, for how long, and whether they passed embedded assessments

- On-demand access: Employees can complete required training at their convenience without scheduling conflicts

- Cost efficiency: Eliminates travel costs, venue expenses, and the productivity loss of pulling employees from their desks

With features like in-video quizzes, completion certificates, and SCORM-compliant reporting, enterprise video platforms integrate seamlessly with existing Learning Management Systems (LMS) to create a comprehensive compliance training ecosystem.

See more: Video Training Platform

2. Secure Internal Communications

In an era of distributed workforces and multiple branch locations, video has become essential for internal communications. Banks use enterprise video platforms for:

- Executive town halls: CEO and leadership communications reaching thousands of employees simultaneously

- Policy announcements: Regulatory updates and procedural changes communicated consistently across all branches

- Crisis communications: Rapid deployment of critical information during security incidents or market disruptions

- Meeting recordings: Secure storage and sharing of recorded video conferences from platforms like Zoom, Microsoft Teams, and Cisco Webex

Unlike consumer video platforms, enterprise solutions provide granular access controls, ensuring that sensitive communications reach only authorized personnel.

See more: Corporate Video Streaming

3. Knowledge Management and Institutional Memory

Financial institutions possess vast amounts of institutional knowledge that often exists only in the minds of experienced employees. Video platforms help capture and preserve this knowledge through:

- Subject matter expert recordings: Capture specialized knowledge before key employees retire or change roles

- Process documentation: Visual guides for complex procedures that are difficult to explain in written format

- AI-powered search: Automatic transcription makes video content searchable by spoken words, enabling employees to quickly find relevant information

See more: Knowledge Management Tools for Video Content

4. Customer Education and Onboarding

Forward-thinking banks use video to enhance the customer experience through educational content:

- Product tutorials: Step-by-step guides for mobile banking apps, online services, and new features

- Financial literacy content: Educational videos on savings, investing, and financial planning

- Fraud prevention: Awareness videos helping customers identify and avoid common scams

Essential Features of a Banking Video Platform

When evaluating video platforms for financial services, look for these critical capabilities:

Security and Compliance Features

- Encryption: FIPS 140-2 compliant AES-256 encryption for data at rest and in transit

- Access controls: Role-based permissions, IP restrictions, and geo-blocking capabilities

- Single Sign-On (SSO): Integration with enterprise identity providers like Azure AD, Okta, and Ping

- Audit trails: Comprehensive logging of all user actions for compliance reporting

- Data residency: On-premises or regional cloud deployment options for data sovereignty requirements

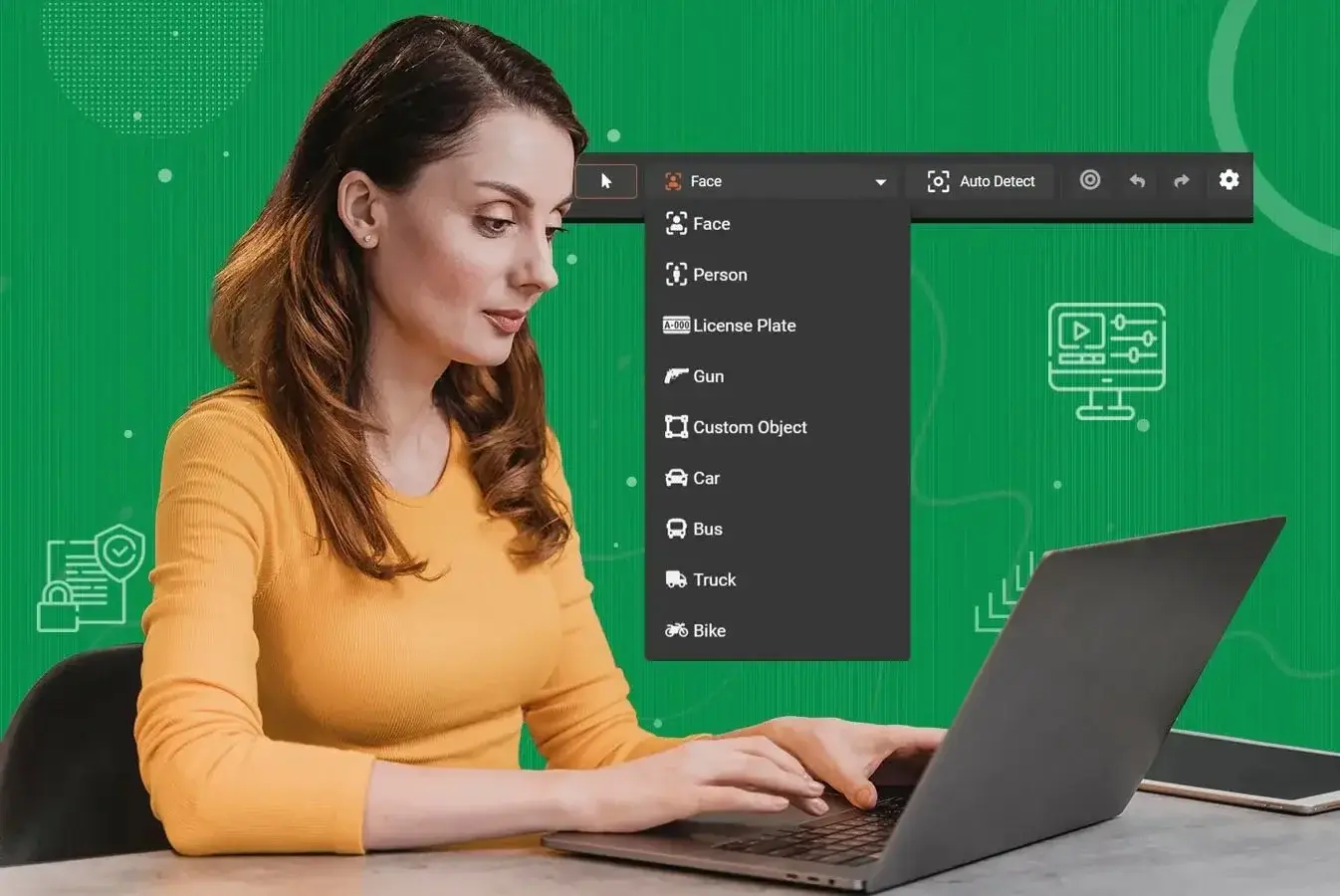

AI-Powered Capabilities

Modern enterprise video platforms leverage artificial intelligence to enhance productivity and accessibility:

- Automatic transcription: Convert spoken content to searchable text in 40+ languages

- AI-powered search: Find specific content by searching through spoken words, objects, and on-screen text

- Automatic tagging: AI-generated metadata for improved content organization and discovery

- Video summarization: Auto-generated summaries and chapter markers for long-form content

- PII redaction: Automatic detection and redaction of sensitive information in video content

See more: AI Enterprise Video Platform

Integration Capabilities

A banking video platform should integrate seamlessly with your existing technology stack:

- LMS integration: Connect with Moodle, Cornerstone, SAP SuccessFactors, and other learning platforms

- Video conferencing: Automatic ingestion of recordings from Zoom, Microsoft Teams, Cisco Webex, and GoTo Meeting

- Content management: Integration with SharePoint, Drupal, and other CMS platforms

- Analytics tools: Connection with Google Analytics, Woopra, and business intelligence systems

See more: Video Integration

Compliance Standards for Banking Video Platforms

Financial institutions operate under strict regulatory requirements. Any video platform must support compliance with:

|

Regulation |

Key Requirements for Video Platforms |

|

SOC 2 Type II |

Security controls, availability, processing integrity, confidentiality, and privacy |

|

FINRA |

Record retention, supervision requirements, and communications compliance |

|

PCI-DSS |

Protection of cardholder data, access controls, and encryption standards |

|

GLBA |

Safeguarding of customer financial information and privacy notices |

|

GDPR |

Data protection, consent management, and right to erasure for EU customers |

See more: Enterprise Video Platform for Finance

Implementation Best Practices

Successfully deploying a video platform in a banking environment requires careful planning:

- Start with a pilot program: Begin with a specific department or use case—such as compliance training—before expanding organization-wide.

- Engage stakeholders early: Include IT security, compliance, HR, and communications teams in the evaluation process.

- Define governance policies: Establish clear guidelines for content creation, approval workflows, retention periods, and access controls.

- Plan for integration: Map out connections with existing systems, including LMS, SSO providers, and video conferencing tools.

- Train content creators: Provide guidance on creating effective video content that meets both quality and compliance standards.

See more: Video CMS

Measuring ROI: The Business Case for Banking Video Platforms

Financial institutions that implement enterprise video platforms typically see measurable returns across several areas:

- Training cost reduction: Organizations report 40-60% reductions in training delivery costs by shifting from classroom to video-based learning

- Compliance efficiency: Automated tracking and reporting significantly reduce the administrative burden of compliance documentation

- Knowledge retention: Video-based training shows 25-60% higher retention rates compared to text-based materials

- Time savings: AI-powered search reduces the time employees spend looking for information by up to 35%

Getting Started with VIDIZMO EnterpriseTube

VIDIZMO EnterpriseTube is a Gartner-recognized enterprise video platform trusted by financial institutions worldwide. With ISO 27001 certification, SOC 2 compliance, and flexible deployment options including Azure Government and AWS GovCloud, EnterpriseTube provides the security, compliance, and functionality that banks require.

Key capabilities for financial services include:

- End-to-end encryption with FIPS 140-2 compliant AES-256

- AI-powered transcription, search, and content intelligence

- Integration with Zoom, Microsoft Teams, and leading LMS platforms

- Comprehensive audit trails and compliance reporting

- On-premises, private cloud, and hybrid deployment options

People Also Ask:

What is the difference between video banking and a video platform for banking?

Video banking refers to customer-facing solutions that enable video calls between customers and bank staff for services like account opening or loan applications. A video platform for banking is an enterprise content management solution for internal use cases like training, communications, and knowledge management. Many financial institutions use both—video banking for customer interactions and enterprise video platforms for internal operations.

Can a banking video platform integrate with our existing LMS?

Yes, enterprise video platforms like VIDIZMO EnterpriseTube integrate with major LMS platforms including Moodle, Cornerstone, SAP SuccessFactors, and others through SCORM compliance and API connections. This integration enables seamless content delivery and automatic reporting of training completion data.

What deployment options are available for financial institutions?

Modern enterprise video platforms offer flexible deployment options: SaaS (cloud-hosted), private cloud (Azure Government, AWS GovCloud), on-premises, and hybrid configurations. This flexibility allows banks to meet specific data residency, security, and compliance requirements.

How does a video platform ensure FINRA compliance?

FINRA-compliant video platforms provide comprehensive audit trails, customizable retention policies, access controls, and the ability to place legal holds on content. These features support the record-keeping and supervision requirements mandated by financial regulators.

Jump to

You May Also Like

These Related Stories

HIPAA-Compliant Video Redaction Tools for Healthcare

10 Ways to Enhance Your Company's Internal Communications with Video

No Comments Yet

Let us know what you think