Debt collection agencies face an increasingly complex challenge: safeguarding sensitive PII from calls. Learn how PII redaction software can help safeguard this data through call redaction, ensuring compliance and protecting your agency from potential risks.

With the rise of stringent regulations such as GLBA, PCI-DSS, HIPAA, and FDCPA Regulation F, failing to secure and adequately retain debt data can lead to severe consequences.

Why is this the case? Well, this occurs because over the course of a debt's lifecycle, a significant amount of personal information is shared between borrower and lender.

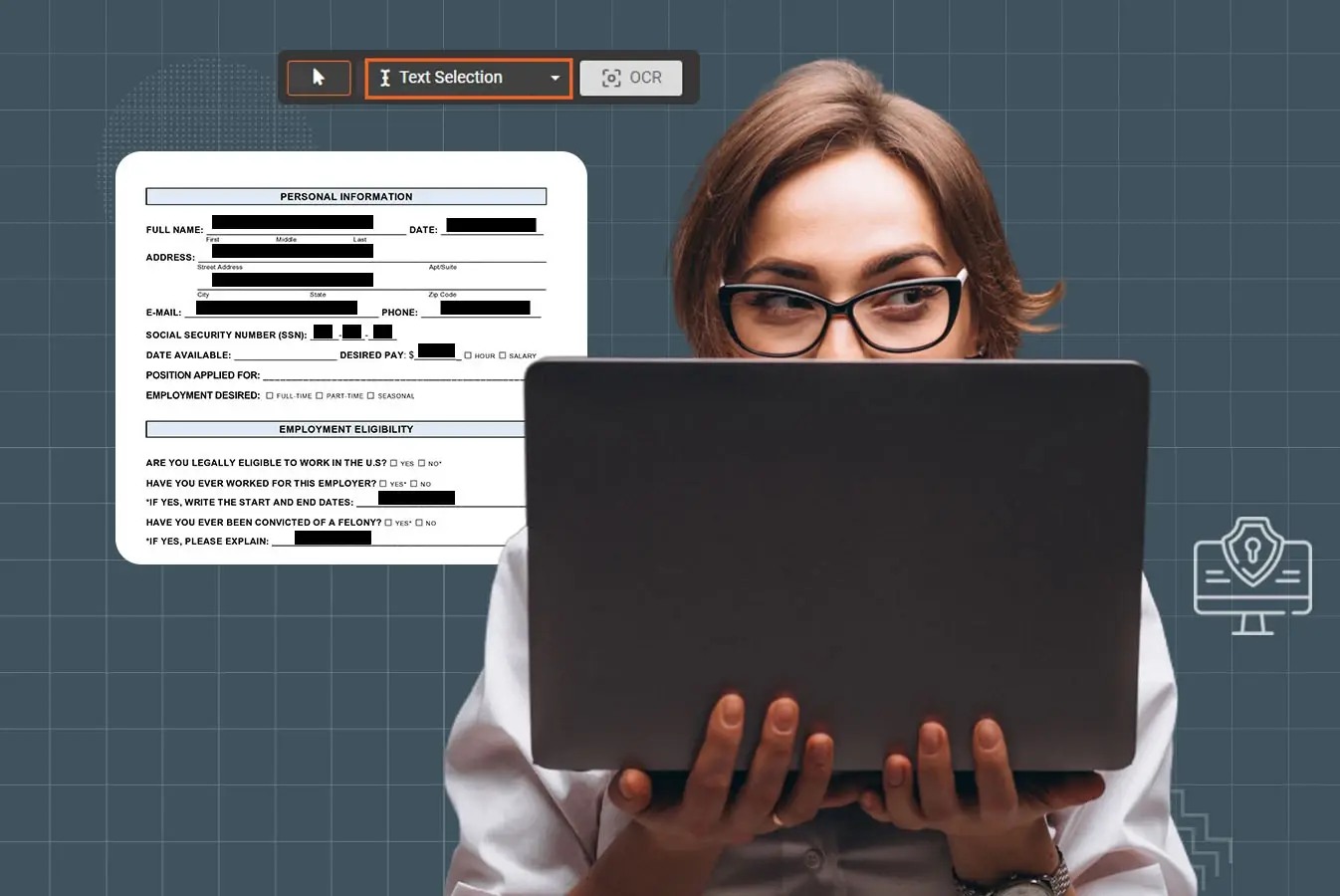

As such, debt collection agencies face the challenge of manually reviewing and managing sensitive data, including Social Security numbers, medical records, account details, and payment histories. Redacting thousands of calls manually is time-consuming and prone to human error, increasing the risk of data exposure.

This growing pressure highlights the need for practical solutions, particularly PII redaction software, to protect sensitive information through automated call redaction.

This blog will explore how PII redaction software can automate the call redaction process, ensuring that sensitive data is consistently protected and helping debt collection agencies overcome the challenges of safeguarding and retaining sensitive information.

The Need to Redact PII from Calls With PII Redaction Software

Many debt collectors begin calls by informally verifying basic details with the debtor to prevent the inadvertent disclosure of debt-related information to unauthorized individuals. However, PII, PHI, and CCI are often collected during this verification process.

It is essential to safeguard this information to ensure compliance and protect individuals' privacy. Such information includes:

Personally Identifiable Information (PII)

- Full names

- Mother's maiden name

- Last four digits of Social Security Number

- Addresses

- Date of birth

- Phone number

- Recent transactions

Protected Health Information (PHI)

- Medical records

- Insurance Information

- Other medical debt-related data

Payment Card Information (PCI)

- Bank account numbers

- Checking account number

- Debit/credit card information

This sensitive information is governed by regulations such as GDPR, GLBA, and HIPAA, and debt collectors are obligated to protect it at all costs. However, many agencies still rely on traditional, manual methods to redact and store this data, exposing themselves to significant risks.

Furthermore, debt collection calls are typically recorded for dispute resolution or audit purposes to track compliance with fair debt collection practices (FDCPA Regulation F).

While these recordings are valuable for documentation, they also present a substantial risk if not handled or redacted correctly to ensure compliance with the GLBA, as mentioned above.

This is where the need to redact PII from calls becomes paramount. Using robust PII redaction software to redact call recordings and securely retain them ensures that sensitive information is effectively protected, allowing agencies to comply with regulations like FDCPA Regulation F, GLBA, PCI DSS, and HIPAA (for medical debts).

The Challenges of Data Protection and Call Redaction in Debt Collection

Let’s take a closer look at the challenges debt collection agencies face when trying to manage redaction manually:

Large Call Volume

If the call volume for your debt collection agency is large, say, tens of hours of audio daily, manually reviewing and redacting these calls is impossible. And without automation, valuable time is spent listening to every call and manually identifying sensitive data.

Human Error

In a manual process, human error is inevitable. An agent or compliance officer may miss critical information that should have been redacted, such as Social Security numbers, medical details, or financial records. Even a single missed piece of data can result in a non-compliance penalty.

Regulatory Pressures

Debt collection agencies are required to maintain recordings for compliance purposes. Under Regulation F of the FDCPA, agencies must retain records for at least three years, which includes redacting all sensitive data from recorded calls. Failing to redact this information properly puts the agency at risk for regulatory fines and breaches of consumer trust.

Data Security

When sensitive information is stored improperly or not redacted, it becomes vulnerable to unauthorized access and potential data breaches. Debt collectors handling PII, PHI, and PCI data face significant cybersecurity risks, especially when recorded calls are stored without adequate security measures.

Debt collectors can't afford to ignore these risks, but how can they navigate these challenges effectively? Manual redaction isn't just outdated—it's dangerous.

Automating Call Redaction with PII Redaction Software

The solution to these complex challenges lies in PII redaction software. By automating the redaction process, debt collection agencies can ensure they remain compliant with GDPR, HIPAA, PCI DSS, and FDCPA Regulation F while safeguarding sensitive data. Here’s how:

Bulk Redaction for Stored Calls

For agencies with large volumes of recorded calls, PII redaction software automates the process of scanning and redacting sensitive data from previously recorded conversations. This software can process hours of recordings quickly and accurately, ensuring that no sensitive information is exposed or stored improperly.

Compliance and Audit-Ready

Integrating PII redaction software with existing systems, debt collection agencies can ensure that their call data remains compliant with the latest regulations, such as GDPR, HIPAA, and PCI DSS.

Furthermore, automated software generates audit logs documenting when redactions were made, who approved them, and which data was redacted. This makes it easy to comply with audit requirements and demonstrate due diligence.

AI-Driven Accuracy

Leveraging AI-powered redaction, the software can intelligently detect sensitive information in calls, going beyond just names and numbers to recognize more subtle forms of sensitive data. This AI-driven approach reduces the risk of human error and improves redaction accuracy.

Scalability and Flexibility

As debt collection agencies grow, so does their call volume. PII redaction software scales effortlessly, handling increased call volumes and larger data sets without compromising performance or accuracy.

Data Security

The software offers robust encryption, access control, and granular user permissions to ensure that only authorized personnel can access sensitive data. This addresses the risk of data breaches and helps agencies remain compliant with industry regulations like GLBA and PCI DSS.

Redact PII from Call Recordings with VIDIZMO's Call Redaction Software

VIDIZMO Redactor is an AI-powered solution designed to help debt collection agencies automatically redact sensitive PII from call recordings, ensuring compliance with regulations like GLBA, HIPAA, PCI DSS, and FDCPA Regulation F.

It supports flexible deployment (on-premise, cloud, hybrid, or SaaS), integrates easily via APIs, and scales for bulk redaction needs.

Key features include spoken PII redaction, granular access control, audit logging, encryption, data retention management, SSO support, and secure sharing—enabling agencies to manage sensitive data efficiently and securely without disrupting operations.

Simplify Call Redaction to Protect PII and Ensure Compliance

Debt collection agencies handle and store large volumes of call recordings, making protecting the sensitive Personally Identifiable Information (PII) within these calls essential. PII redaction software offers an effective solution to help agencies address the challenges of managing these recordings while ensuring data protection and compliance.

Sensitive information such as the last four digits of SSNs, names, mother's maiden names, dates of birth, addresses, phone numbers, and medical information (including PHI) related to medical debt must be securely protected.

Additionally, any PCI-related information, such as checking account numbers, debit/credit card details, and account numbers, must be redacted to prevent exposure and ensure compliance.

VIDIZMO Redactor, with its automated features, simplifies the process of call redaction, ensuring sensitive data is adequately protected while maintaining compliance with industry regulations.

Protect your data and ensure compliance today with VIDIZMO Redactor's call redaction.

People Also Ask

What is PII redaction software?

PII redaction software automatically removes or hides sensitive information, such as Social Security numbers, medical records, or account details, from call recordings to ensure compliance with data protection laws.

Why is it important to redact PII from calls in debt collection agencies?

Call redaction helps debt collection agencies protect sensitive data, comply with regulations like GDPR and HIPAA, and avoid potential penalties by ensuring that PII is securely removed from call recordings.

How does call redaction software improve compliance?

PII redaction software automates the process of securing sensitive information, making it easier for debt collection agencies to comply with privacy regulations, track audit logs, and meet strict data retention and security requirements.

What challenges do debt collection agencies face with manual call redaction?

Manual call redaction is time-consuming, prone to human error, and difficult to scale. Agencies often struggle to meet compliance requirements while handling large volumes of sensitive data manually.

What features should debt collection agencies look for in redaction software?

Key features include bulk redaction, AI-driven accuracy, granular access control, encryption, and compliance-ready audit logs, which ensure data security and streamline the redaction process.

How does VIDIZMO Redactor help debt collection agencies?

VIDIZMO Redactor automates call redaction, ensuring that sensitive data is securely protected, complies with industry regulations, and improves operational efficiency, particularly for agencies dealing with large volumes of recorded calls.

Can VIDIZMO Redactor integrate with existing systems?

Yes, VIDIZMO Redactor can easily integrate with existing systems like call recording platforms and CRMs through APIs, making it simple for debt collection agencies to incorporate redaction into their workflows without disruptions.

No Comments Yet

Let us know what you think